puerto rico tax incentives 2021

The Incentives in a Nutshell. Puerto Rico offers the security and stability of operating in a US jurisdiction with an array of special tax incentives for foreign direct investment that can be found nowhere else in the world.

Tax Weary Americans Find Haven In Puerto Rico Frost Law Washington Dc

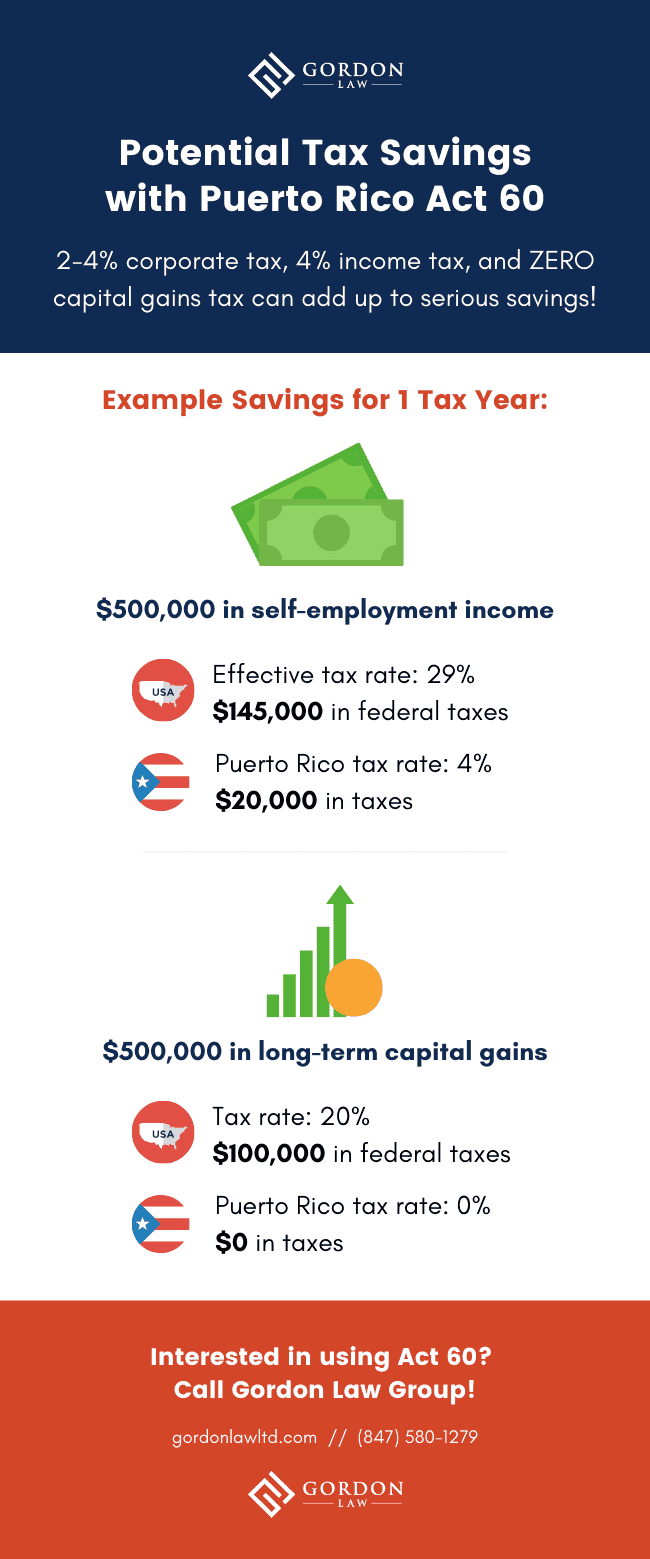

Both tax incentives on their own are quite favorable and when combined can result in significant tax savings.

. Most recently then Governor of Puerto Rico Ricardo Rossello signed Act 60-2019 Incentives Act into law on July 1 2019 with an effective date of January 1 2020. Income from personal services performed within Puerto Rico will not be considered from Puerto Rican sources if it is 3000 United States dollars USD or less and the individual was present in Puerto Rico for 90 days or less. Citizens that become residents of Puerto Rico.

INDIVIDUAL RESIDENT INVESTOR Act 60-2019 Section 202101 former Act 22 Background. A bona-fide resident of Puerto Rico can avoid including all or part of the income or dividends from the company in US. The jobs and economic impact anticipated by the Puerto Rico government never materialized.

Also during the year 2012 two additional laws were enacted. Benefits of establishing relocating or expanding businesses in Puerto Rico. The wealthy given outrageous incentives to colonize Puerto Rico while native residents suffer.

Part of Puerto Ricos government tax incentive programs require buying a home within the first two. Additionally Act 20 also incorporated into Act 60 significantly reduces the tax rate for businesses that export goods or services outside of Puerto Rico to 4 from the ordinary 375 corporate tax rate in Puerto Rico. In 2008 a new Economic Incentives Act for the Development of Puerto Rico herein after Act 73 or Economic Incentives Act went into effect.

Alongside Democratic Reps. Purpose of Puerto Rico Incentives Code Act 60. Puerto Rico Tax Incentives.

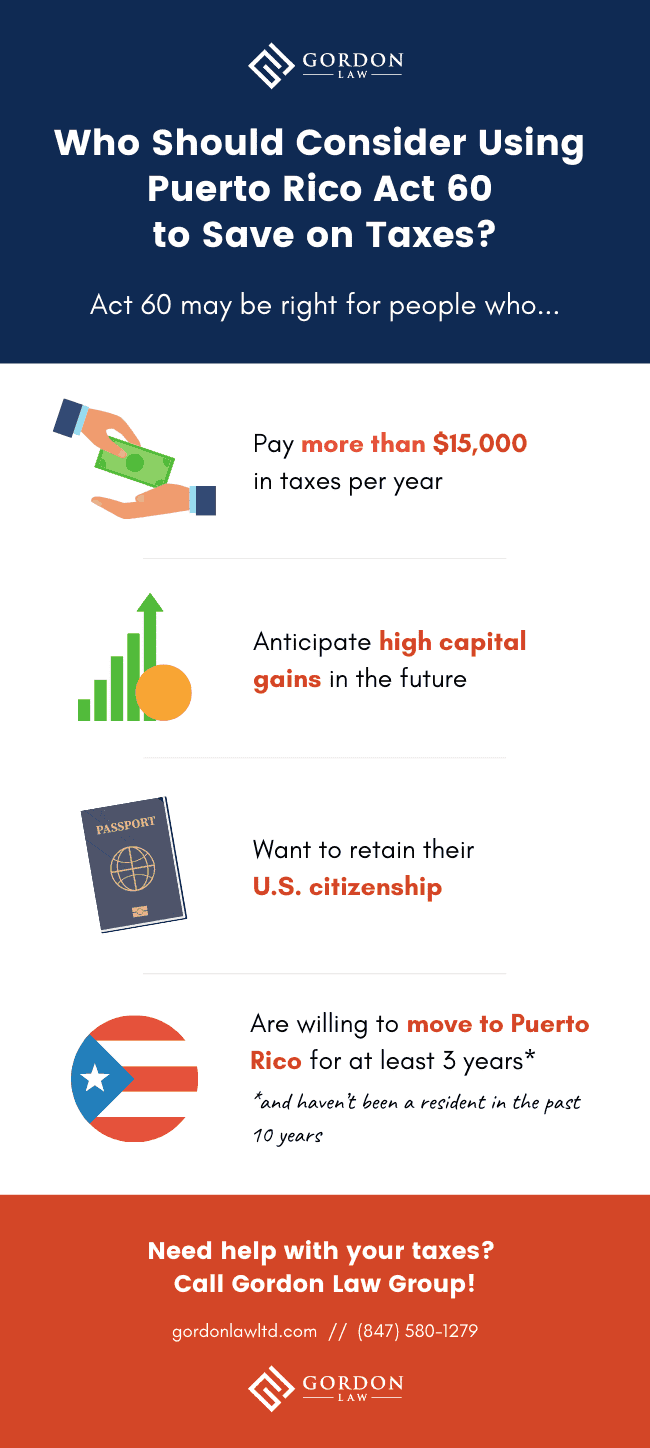

To be eligible investors must donate 10000 to nonprofit entities in Puerto Rico. The purpose of Act 60 is to promote investment in Puerto Rico by providing investment residents with tax breaks. If keeping more of your hard-earned income appeals to you you might have already researched Puerto Ricos Act 60 tax exemption program.

From being an instrument to attract millionaires and foreign investment Act 22 went on to become a haven for cryptocurrency fans YouTube personalities and consultants. Puerto Rico has a de minimis rule to avoid sourcing to Puerto Rico very small amounts of income from personal services. Please note that these benefits are in addition to the fact that Puerto Rico is a US Territory exempt from federal taxes.

Posted on June 16 2021 by admin. Puerto Rico Act 22 Tax Incentive Fails. Read more about.

27 2021 the Internal Revenue Service IRS announced a new compliance campaign focusing on the Puerto Rico Act 22 now Act 60. Private wealth clients hedge fund managers and cryptocurrency traders fleeing to Puerto Rico for its huge tax breaksand to escape President Joe Bidens proposed. 19 2019 letter to Treasury Sec.

Steven Mnuchin demanding greater oversight into and more information about the Puerto Rico tax incentives that are resulting in US. The 2008 Economic Incentives for the Development of Puerto Rico Act EIA provides a wide array of tax credits and incentives that enable local and foreign companies dedicated to certain business activities to operate within Puerto Rico. 28 May 2021.

Puerto Rico decided to double down on tax incentives in 2019 with a new law making the island even more appealing for new businesses and investors. Act 20 and Act 22 promoting the export of services from Puerto Rico and the transfer of wealthy individuals to Puerto Rico. Many sizable tax breaks like these are offered across a variety of industries making Puerto Rico Americas last true tax haven.

The program boasts a 0 capital gains tax rate and a 4 corporate tax rate. José Serrano Nydia Velázquez and Raúl Grijalva Ocasio-Cortez signed a Dec. June 3 2021 146 AM PDT.

If youre looking for a strong return on your investment you need to understand the details of Act 20 and Act 22 Puerto Rico tax incentives for business and individual investorsIn a recent attempt to strengthen its economy and attract investors the local government has stepped up its economic and tax incentives for those wanting to do business here. The tax laws known as Act 20 the Export Services Act and Act 22 the Individual Investors Act shields new residents residing in Puerto Rico for at least half of the. Married Couples May Save Thousands By Filing Form 1040 Separately For 2021.

Sunday July 25 2021 - 1200. Authored by Manny Muriel. Apr 5 2022 10.

The tax breaks fall under a law known as Act 60 a version of which was initially enacted by the Puerto Rico government under another name in 2012 as the island faced a looming economic collapse. Act 60 consolidated various tax decrees incentives subsidies and benefits including Acts 20 and 22. One of the most well-known Puerto Rican tax incentives the Individual Resident Investor tax incentive is available to any person who was not a resident of Puerto Rico for the 10 tax years preceding July 1 2019 and who becomes a resident before December 1 2035.

Puerto Rico - Green Energy Fund Tier I Incentive Program. As provided by Act 60. Puerto Rico offers tax incentives packages which can prove attractive to US mainland.

Legacy Act 20 generally provides for a 4 tax rate on income from specified export activity. Tuesday December 21 2021. The law has enabled high-income individuals and profitable service.

Acts 20 and 22 were intended to incentivize investment in Puerto Rico promote the exportation of services. Under Act 22 bona fide residents of Puerto Rico who qualify can completely eliminate capital gains tax with a 100 tax exemption on assets acquired after the applicant has. In January of 2012 Puerto Rico passed legislation making it a tax haven for US.

In addition to Act 20 Puerto Rico also passed Act 22 known as the Individual Investors Act so as to attract wealthy individual investors to relocate to the Island. The Puerto Rican government is luring businesses and investors to their beautiful island with attractive tax incentives like a 4 corporate tax rate and a 0 tax rate on capital gains. SemDem for Community Contributors Team.

Puerto Rico has a long history of using tax incentives and credits as tools for economic development and recovery after economic crises. Lets explore the tax implications pitfall and tripwires for US individuals to be aware of before relocating to Puerto Rico. Act 60-2019 the Puerto Rico Incentives Code groups together most of Puerto Ricos incentives laws into a single uniform code.

Could Puerto Rico Be Your Crypto Tax Haven Gordon Law Group

Tax Incentives Is Relocating To Puerto Rico The Right Move For You

Implications Of Puerto Rico S Territory Status In 2021 Economic Stimulus Spending Puerto Rico Report

Guide To Income Tax In Puerto Rico

Puerto Rico Tax And Incentives Guide Grant Thornton

Acts 20 And 22 Created A Class Of Intermediaries Who Manage Tax Exemptions Centro De Periodismo Investigativocentro De Periodismo Investigativo

Enjoy Lower Taxes With Puerto Rico S Act 60 Tax Incentives Relocate To Puerto Rico With Act 60 20 22

Could Puerto Rico Be Your Crypto Tax Haven Gordon Law Group

Average Salary In Puerto Rico 2022 The Complete Guide

Guide To Income Tax In Puerto Rico

![]()

Taxation Puerto Rico Move To Puerto Rico And Pay No Capital Gains Tax

Supreme Court Seems Divided Over Puerto Rico S Exclusion From Federal Benefits

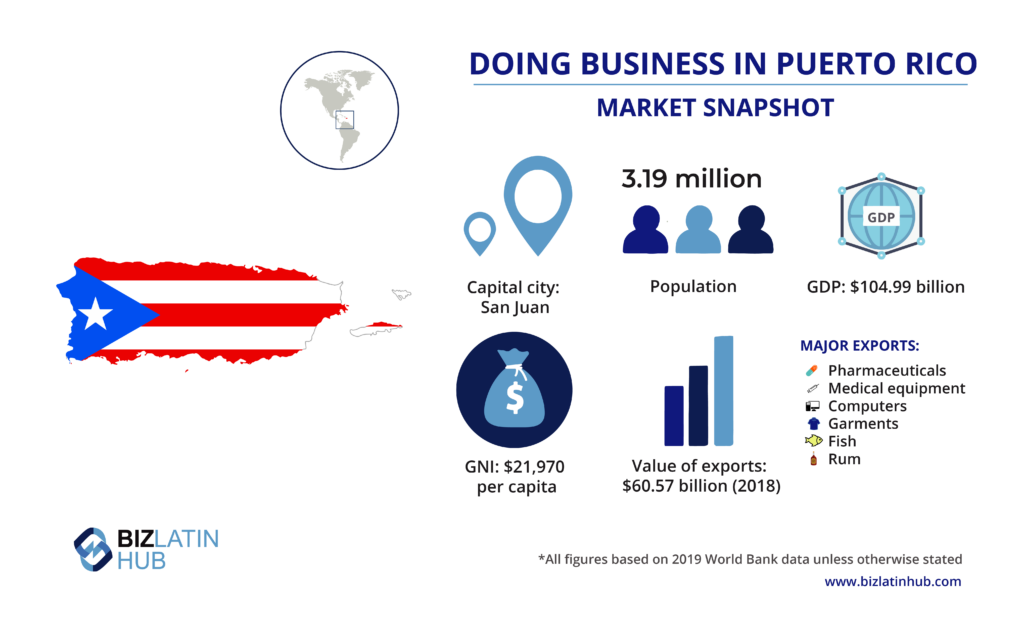

4 Business Opportunities In Puerto Rico Biz Latin Hub

Puerto Rico Tax Haven Is Alluring But Are There Tax Risks

Us Tax Filing And Advantages For Americans Living In Puerto Rico

Puerto Rico Tax Act 60 Business Opportunities And Tax Incentives In The Caribbean

Puerto Rico Maps Facts Puerto Rico Puerto Rico Map Puerto

Puerto Rico Tax Incentives Fee Increases Relocate To Puerto Rico With Act 60 20 22